Advanced Candlesticks Course

Learn the 7 most consistent and reliable Candlesticks in modern trading and investing that lets you know when a trend is beginning, ending in Real-Time, Not In Hindsight.

Advanced Bear Market Secrets

There are Topping Patterns Every Short Seller Needs To Know and we reveal them here. Learn how to spot and short market tops that turns into bearish trends or markets.

Advanced Earnings Season Course

Discover why earnings season is the one of the best times to Grow You Portfolio With Consistent Winning Trades and very little risk. This is a must for any serious investor.

Secrets To IPO Stocks That Double In Price

Discover the Unique Pattern that Winning IPO stocks display Before They "Double, Triple, Or More In Price" like FB, AMZN, TSLA, and more.

Seasonality Trading Course

Every stock has a seasonal period when it rallies (1-800-Flowers [FLWS] in Feb due of Valentine's day). Learn how to tell when each stock's seasonal trend is ready to rally.

VIX Trading Course

This VIX Strategy shows you How To Tell When Market Volatility Is Over and how to use this information to identify market bottoms or reversals. No guessing, hoping, or wishing.

Bouncing Stocks Course

One of Wally's best kept secret for generating bi-weekly and monthly income is through Bouncing Stocks. These stocks bounce between support and resistance levels repeating the process every 2-6 weeks. Find out how to spot them, trade them and generate consistent paychecks every 2-6 weeks.

Dividend Capturing Strategy

This strategy involves buying a dividend paying stock, collecting the dividend, and then selling the stock. The goal is to capture the dividend income and potential profit from a stock's price increase at the same time

Pump and Dump Strategy

This strategy was created to capture shorting opportunities in low-price stocks (penny stocks) after spiking up (sometimes 50% to 1,000%) in a few short days and identifying when the spike is over and the stock is ready to come crashing back down which presents great shorting opportunities.

Stochastic Pop Strategy

This strategy was created to identify what is known as stochastic pop and how to trade it. A stochastic pop is when market conditions (or a stock) is overextended (overbought) but price continues to go higher.

Right Side Platform

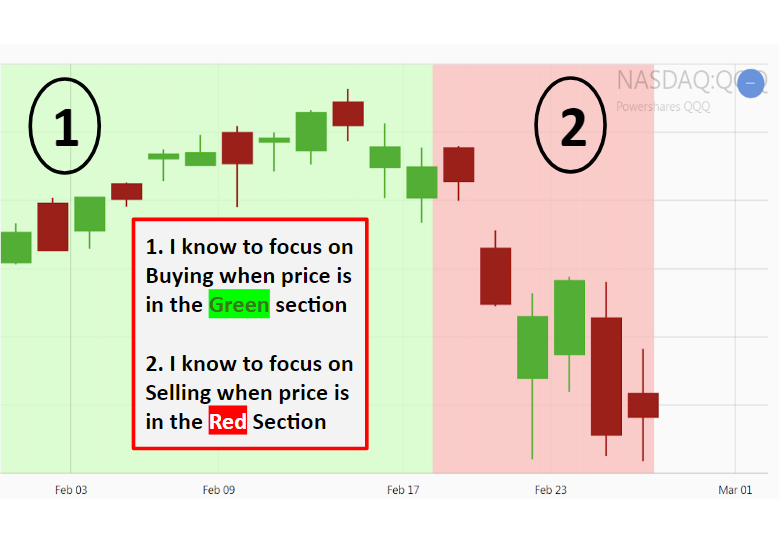

See Where Stocks Are Headed

Ever feel like the stock market is complicated risky, and unpredicatable?

Professionals are using a new method called QUANTITATIVE ANALYSIS to keep them on the "Right Side."

Our Right Side Platform uses Quantitative, Technical and Fundamental analysis to keep us on the Right Side.

We Invest In

Healthy Stocks

Understanding the nature of a truly healthy stock makes a big difference when it comes to selecting and investing in stocks that can do well instead of worrying about losing your investment.

Learn to identify good healthy stocks that are in an uptrend and ready for the next trend higher, not in hindsight, but as it is actually happening.

Buying At Discount Low Price

After identifying good healthy stocks, we make sure that we focus on buying at low discounted prices to get the best deals before the stock goes up in price.

Find out how you can tell, not guess, when a stock is being offered truly at discounted prices right before they begin going higher in price.

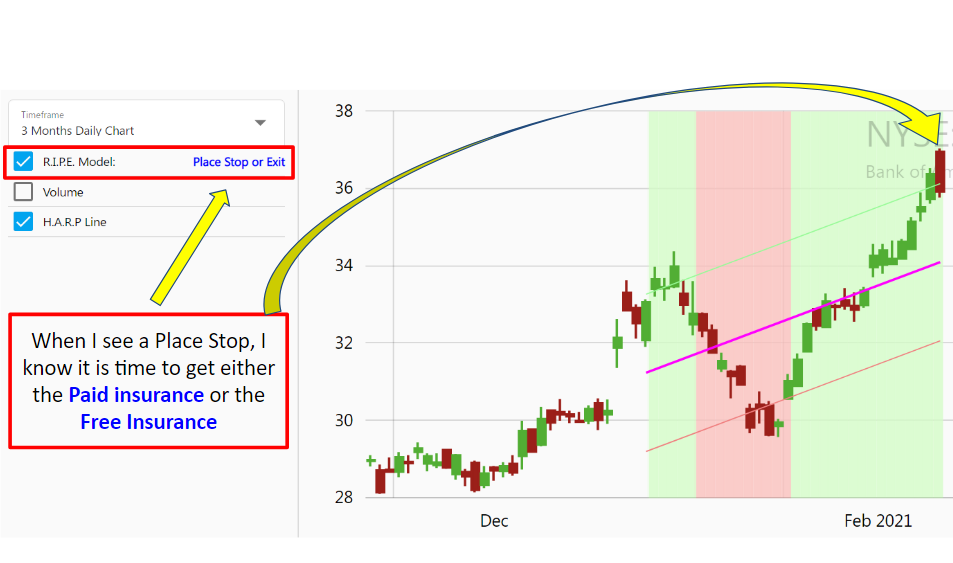

Get Insurance On

Your Stocks

Next, after identifying a good healthy stock at low discounted prices, learn how to remove doubts, alleviate fear, and reduce your risk by making sure you know when to get insurance on your stocks.

The only reason why the stock market can be risky is because most traders do not have the adequate insurance to file a claim on their losses.

If you understand the value of insuring your house and car, then why won't you insure your stocks and portoflio? Don't know how? We can help you.

Know How Much Profit Before Buying

Here is the best part. Before we buy any stock, we can anticipate how much money a stock can potentially make without having to guess, hope or wish...AHEAD OF TIME!!!

We use the proprietary R.I.P.E. model to assess a reasonable and realistic profit expectation that can be generated based on a number of quantitative and historical data.

Trading on the Right Side With Confidence